Dimerco Releases January 2026 Asia-Pacific Freight Market Report: Navigating a Complex Global Landscape

Airfreight stays strong across Asia on AI and tech exports, while ocean markets remain soft amid capacity imbalances and Lunar New Year disruptions.

Ocean freight will be shaped more by capacity imbalances and regional disparities, while airfreight remains robust, driven by high-tech and e-commerce demand.”

TAIPEI, TAIWAN, January 6, 2026 /EINPresswire.com/ -- Dimerco Express Group, a global leader in logistics and supply chain solutions, has released its January 2026 Asia-Pacific Monthly Freight Report, providing critical insights into the region's dynamic freight landscape.— Catherine Chien, Chairwoman, Dimerco Express Group

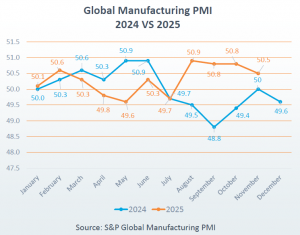

Key findings indicate mixed conditions across global markets, with the Global Manufacturing PMI showing slower growth at 50.5, down from 50.8, marking the lowest point in four months. This reflects uneven sector performances, with consumer and intermediate goods expanding, while investment goods contract.

The report highlights:

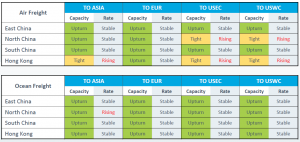

⦿ Northeast Asia sees strong airfreight demand driven by AI and semiconductor exports, tightening capacities notably to the US and intra-Asia. Ocean freight remains soft due to post-holiday slowdowns.

⦿ Southeast Asia experiences significant tightening in both air and ocean capacity ahead of the Lunar New Year, exacerbated by export backlogs and rising e-commerce volumes. Notably, Malaysia, Thailand, and Singapore report substantial capacity constraints and backlogs.

⦿ China Market forecasts strong airfreight activity in Hong Kong and North China, particularly for US-bound routes, whereas ocean freight remains relatively stable with modest seasonal adjustments.

⦿ North America anticipates brief post-holiday softness in air freight, followed by a rapid tightening ahead of Lunar New Year, while ocean freight continues to face demand weaknesses despite approaching holiday peak pressures.

⦿ Europe faces airfreight disruptions due to ongoing strikes across major airports, affecting reliability and capacity. Regulatory changes and operational challenges also contribute to ocean freight instability.

Catherine Chien, Chairwoman of Dimerco Express Group, emphasized cautious optimism for 2026, noting, "Ocean freight will be shaped more by capacity imbalances and regional disparities, with potential disruptions linked to any return to Suez Canal routes. Simultaneously, airfreight remains robust, driven by high-tech and e-commerce demands to North America and Europe."

Ted Chen, Director of Ocean Freight, advises caution despite the extended US-China tariff truce: "Until trade activity clearly recovers, any early return to the Red Sea could add excess capacity and further disrupt an already fragile market."

For a comprehensive understanding of the shifting dynamics in the Asia-Pacific freight market and strategic recommendations, download the full January 2026 Dimerco Asia-Pacific Freight Report.

For interviews, expert commentary or data requests, contact:

Gitte Willemsens

Pesti Group

gitte.w@pesti.io

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.